The cryptocurrency world has been a volatile space, marked by rapid developments, financial gains, and unexpected setbacks. One of the recent and prominent incidents was the collapse of FTX, a well-known crypto exchange. This article explores the implications of the FTX collapse and the potential future direction of the cryptocurrency market.

The FTX Collapse: An Overview:

FTX was a cryptocurrency exchange that had gained a reputation for its innovation, advanced trading features, and the leadership of Sam Bankman-Fried. However, in a surprising turn of events, the exchange faced financial troubles that led to its ultimate collapse. This left many investors and traders concerned about the security and stability of crypto platforms.

Immediate Impact on Investors:

Loss of Funds: Traders and investors using FTX were left in the lurch, with many experiencing significant losses as the exchange ceased operations.

Distrust in Exchanges: The FTX collapse has generated skepticism and a lack of trust in cryptocurrency exchanges, raising questions about the safety of user funds.

The Response of the Cryptocurrency Community:

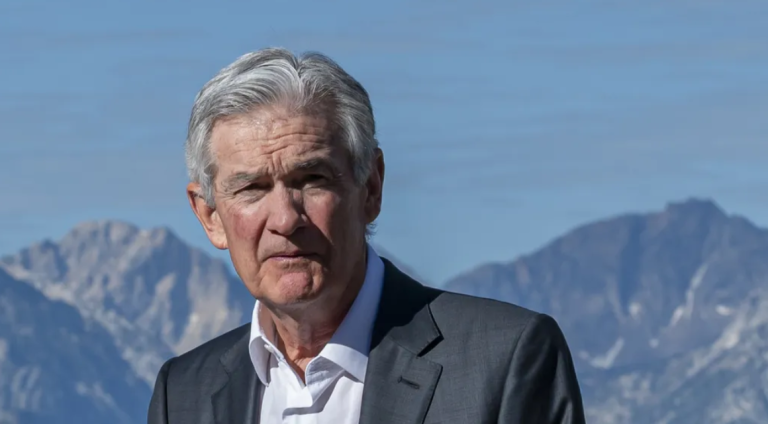

Calls for Regulation: Some experts and investors are advocating for more stringent regulations in the cryptocurrency space to prevent future exchange collapses and protect users.

Rise of Decentralized Exchanges (DEXs): DEXs, which operate on a blockchain and offer a more decentralized and secure trading experience, are gaining popularity as alternatives to centralized exchanges.

The Future of Cryptocurrency Post-FTX:

Increased Regulatory Scrutiny: It’s likely that regulators will intensify their focus on cryptocurrency exchanges. This could lead to more transparency, better security practices, and increased accountability within the industry.

Growth of Decentralized Finance (DeFi): DeFi, which operates independently of traditional financial systems, could become more mainstream as a safer and more transparent alternative.

Development of User-Centric Exchanges: Exchanges that prioritize user security and control over their assets are expected to grow. These platforms empower users to hold their private keys and make their own trading decisions.

Innovations in Security: The FTX incident serves as a stark reminder of the need for robust security measures within the cryptocurrency industry. New security technologies and practices are likely to emerge in response to these challenges.

Taking Responsibility as an Investor:

In this ever-evolving cryptocurrency landscape, it’s essential for investors to take responsibility for the safety of their assets:

Choose Exchanges Carefully: Research exchanges thoroughly, considering their track record, security practices, and regulatory compliance.

Secure Your Assets: Consider using hardware wallets to store your cryptocurrency securely offline, minimizing the risk associated with keeping funds on exchanges.

Stay Informed: Keep up with the latest developments in the cryptocurrency world, including regulatory changes and security best practices.

Conclusion: The Ongoing Evolution of Cryptocurrency:

The collapse of FTX is a notable event that has raised questions about the future of cryptocurrency. While it underscores the need for increased security and regulatory oversight, it’s also an opportunity for the industry to grow and mature. As the cryptocurrency market continues to evolve, staying informed, using secure practices, and advocating for responsible trading will be paramount in ensuring a safer and more transparent ecosystem for all participants.