ESG (Environmental, Social, and Governance) investing has gained substantial traction in recent years as more investors seek to align their portfolios with ethical and sustainable values. This surge in ESG investing isn’t solely driven by altruism; it’s about the profound impact that money can have when it’s channeled into companies that prioritize environmental responsibility, social equity, and ethical governance. In this article, we will explore the transformative power of money in ESG investing, highlighting the key drivers behind this movement, its impact on corporate behavior, and the potential financial rewards for investors.

The Rise of ESG Investing

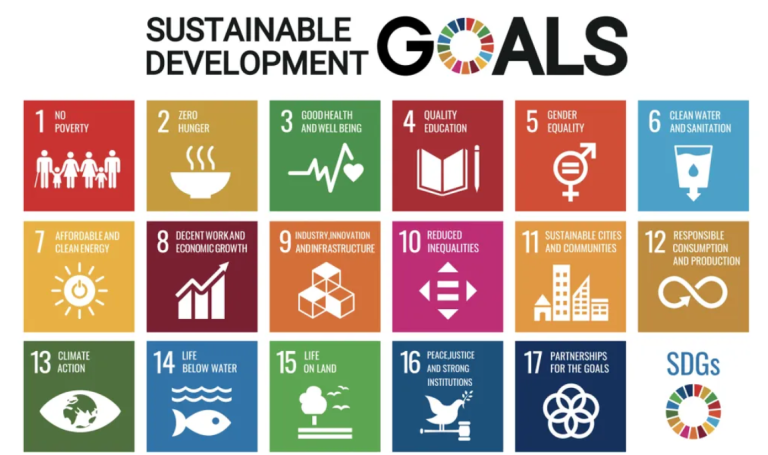

ESG investing goes beyond mere profit-seeking; it’s about using the power of money to promote positive change. As global challenges like climate change, social inequality, and corporate governance scandals have come to the forefront, investors are recognizing the potential of their investments to drive meaningful transformation. This shift is driven by several key factors:

Environmental Concerns: Heightened awareness of climate change, deforestation, and environmental degradation has compelled investors to seek companies that prioritize sustainability.

Social Equity: Increasing attention to issues such as diversity and inclusion, labor rights, and community engagement has prompted investors to support businesses that contribute positively to society.

Governance Standards: Ethical governance is another essential aspect of ESG investing. Investors now scrutinize how companies are run, including board diversity, executive compensation, and shareholder rights.

Regulatory Changes: Governments worldwide are introducing regulations and incentives that encourage ESG investing, reflecting the growing importance of this approach.

Impact on Corporate Behavior

ESG investing has a profound impact on corporate behavior by influencing companies to prioritize ethical and sustainable practices. Here are some ways in which the power of money in ESG investing is driving change:

Risk Mitigation: Companies that incorporate ESG principles into their operations are better equipped to manage risks associated with environmental, social, and governance issues. This proactive approach reduces the likelihood of costly controversies.

Innovation: The influx of capital into ESG-focused companies fuels innovation in green technologies, renewable energy, sustainable agriculture, and more.

Reputation Management: ESG investing encourages companies to safeguard their reputation by adhering to responsible business practices. A positive reputation is critical for attracting customers, investors, and talent.

Long-Term Sustainability: ESG-focused companies are often better positioned for long-term growth and financial stability. Prioritizing sustainability can lead to cost savings and increased customer loyalty.

Access to Capital: Companies that excel in ESG metrics have better access to capital, as they attract investment from ESG-focused funds and investors who prioritize sustainability.

Financial Rewards for Investors

ESG investing is not just about values; it can also deliver strong financial returns. The power of money invested in companies committed to ESG principles can translate into impressive financial rewards for investors. Here’s how:

Alpha Generation: ESG-focused funds and companies have demonstrated the potential for alpha generation. By investing in businesses that outperform their peers in ESG criteria, investors can access a new source of alpha.

Resilience: ESG-focused portfolios have shown resilience in the face of market downturns. Companies with strong ESG practices tend to exhibit financial stability and adaptability, making them less vulnerable to economic shocks.

Long-Term Growth: Sustainability-focused companies often prioritize long-term growth and stability, which aligns with the interests of long-term investors.

Market Opportunities: The green and ethical markets are growing rapidly, presenting investors with opportunities to capitalize on industries like renewable energy, clean technology, and sustainable agriculture.

Ethical Alignment: ESG investors can derive intrinsic satisfaction from knowing that their money is aligned with their values, fostering a sense of purpose alongside financial gains.

Challenges and Considerations

While the power of money in ESG investing is undeniable, it’s not without challenges. Investors should be aware of potential pitfalls, including:

Data Quality: Assessing a company’s ESG performance relies on the availability and accuracy of data. Investors should critically evaluate the quality of ESG data sources.

Greenwashing: Some companies may exaggerate their commitment to ESG principles to attract investments. Due diligence is essential to avoid falling into a greenwashing trap.

Diverse Priorities: Investors should recognize that ESG priorities vary among individuals and organizations. What’s essential for one investor may not align with the priorities of another.

Complexity: ESG investing can be complex due to the multitude of ESG criteria and factors to consider. Investors may require guidance or rely on ESG-focused funds.

In ESG investing, money is a transformative force that drives corporate behavior, encourages innovation, and fosters a sustainable and ethical future. This investment approach is not only about doing good but also about doing well financially. The power of money invested in ESG-focused companies can lead to strong returns, long-term sustainability, and a sense of fulfillment for investors who recognize the profound impact their investments can have on the world. As ESG investing continues to grow, so does the potential to create a more ethical, sustainable, and prosperous global economy.